Will quality of care suffer if Providers offer telehealth?

— And then Covid hit!

Case Study: Telehealth

Biotech | Risk Management | Telehealth

Cigna is a major health insurance company in the middle of major mergers and acquisitions including the purchase of a new telehealth app, MDLIVE. While the app allows Cigna to provide virtual healthcare services at scale instantly, the inability to customize it to Cigna’s specifications didn’t support a larger business vision. In the rush to go to market, it inadvertently cannibalized business from its network of providers.

Role: Lead UXR & Strategist, Service Design

Duration: 18 months

Background & goals

Virtual healthcare is a new space for the insurance giant. After the acquisition of MDLIVE, our goal was to ascertain how much virtual visits should cost patients and how much to pay providers in comparison to in person visits. What type of visits would be covered at all and what value did virtual apps really have. Were providers equipped to provide virtual care on their own and will quality of care suffer. This focus quickly changed as Covid hit about 4 or 5 months into the project.

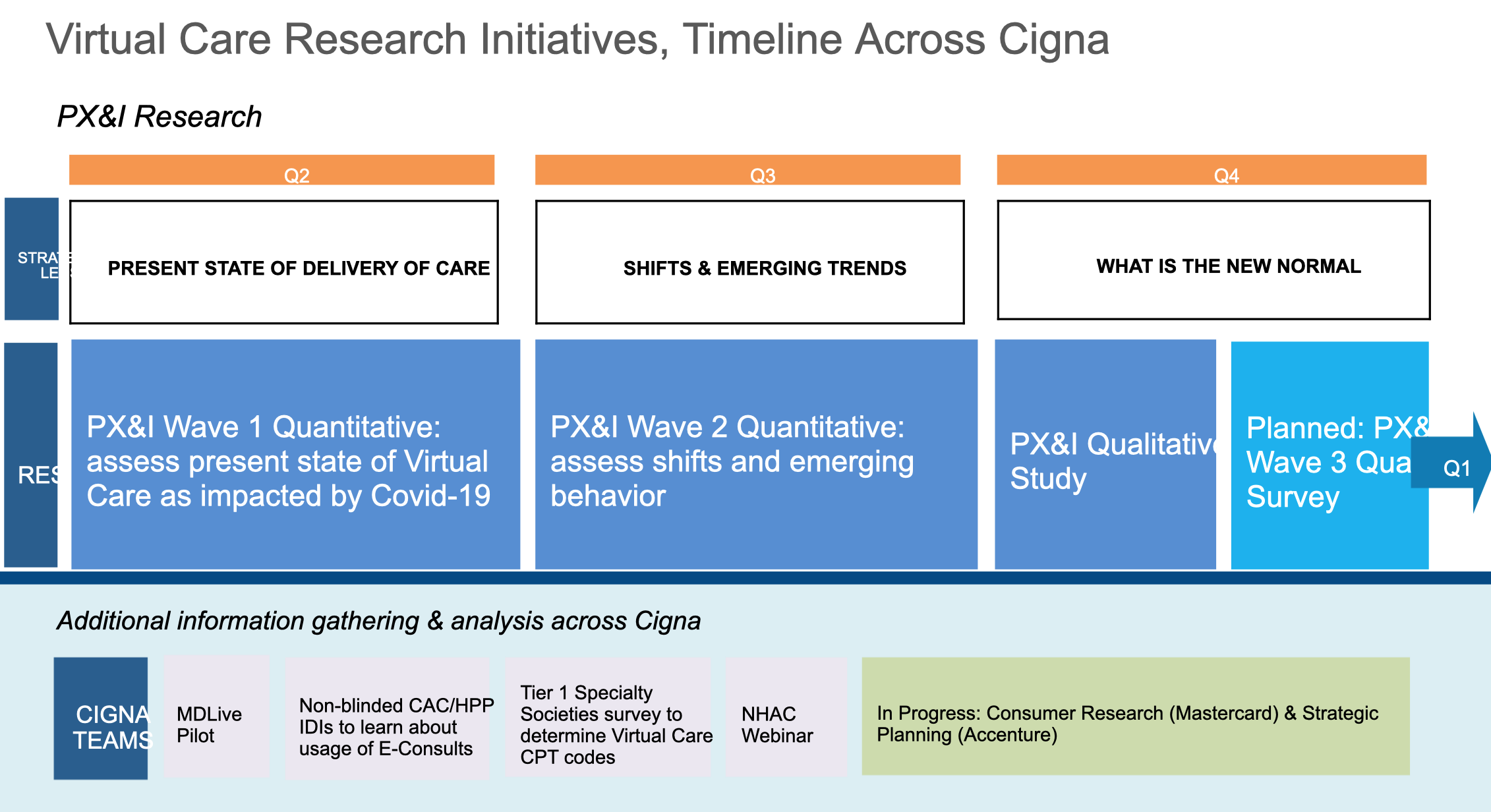

Research goals flexed to assess the impact Covid-19 had on delivery of care and how it drove a new normal across practices and the business of healthcare overall.

Problem to be solved

UXR RECOMMENDATION

Before we can go to market with programs, we must first understand provider attitudes, knowledge and motivations and daily experiences with virtual healthcare as impacted by Covid-19.

And, entry into the Virtual Care space will have an effect on every part of our business, so we need to look at that, too.

STAKEHOLDER CHALLENGE

Business leadership believes that the task at hand is to pilot different reimbursement price points, 50% vs 80% vs 100% to see which one providers accepted.

As the UXR lead, we proposed that this will potentially alienate providers who already think that 1. Cigna is trying to take away their business with MDLIVE, and 2. there are no more in person visits during the early days of Covid, so how are they supposed to keep their business alive and deliver quality of care.

Reframe the hypothesis

with measurable results — make it more “human need” driven rather than cost driven to achieve better results

Hypothesis:

As a leading edge participant in the virtual healthcare space, Cigna will generate increased adoption and affordability of healthcare services and leverage virtual capabilities as a steerage mechanism to higher performing providers and specialists, supporting their businesses rather than funneling it away to a 3rd party.

We know we will be successful when:

Patients do not miss appointments during the pandemic, reducing gaps in care

GIC score increases (Cigna drives business only to high scoring providers), so this is a win-win

Patients who live far away from doctors and hospitals will be able to receive care

Providers will feel confident scaling their businesses, even during a pandemic

UXR Approach

Big Think — Discovery & Planning

Develop learning objectives in conjunction with business stakeholders.

Align stakeholders on the the plan since they only want to pilot a pricing strategy. Lots of meetings! Never ending meetings. And lots of visual artifacts designed specifically to gain traction with stakeholders.

Ask the right questions. Are providers interested in bifurcating time and energy to virtual care? Are virtual practices in the best interest of their business? Will quality of care suffer?

How do we entice providers to participate at all?

Is reimbursing for video-only visits a deal-breaker when phone visits are seen as more efficient by patients, especially older populations?

Are providers tech savvy enough to manage video visits? Do they even have the equipment? What does that investment look like?

Develop Research Plan, timeline, and major milestones. Identifying participants and recruiting.

Dig Deep — Strategic Research

Secondary research, competitor analysis. Where are the gaps in the marketplace. What space should Cigna inhabit? What is the real unmet need? What is the differentiated value-add?

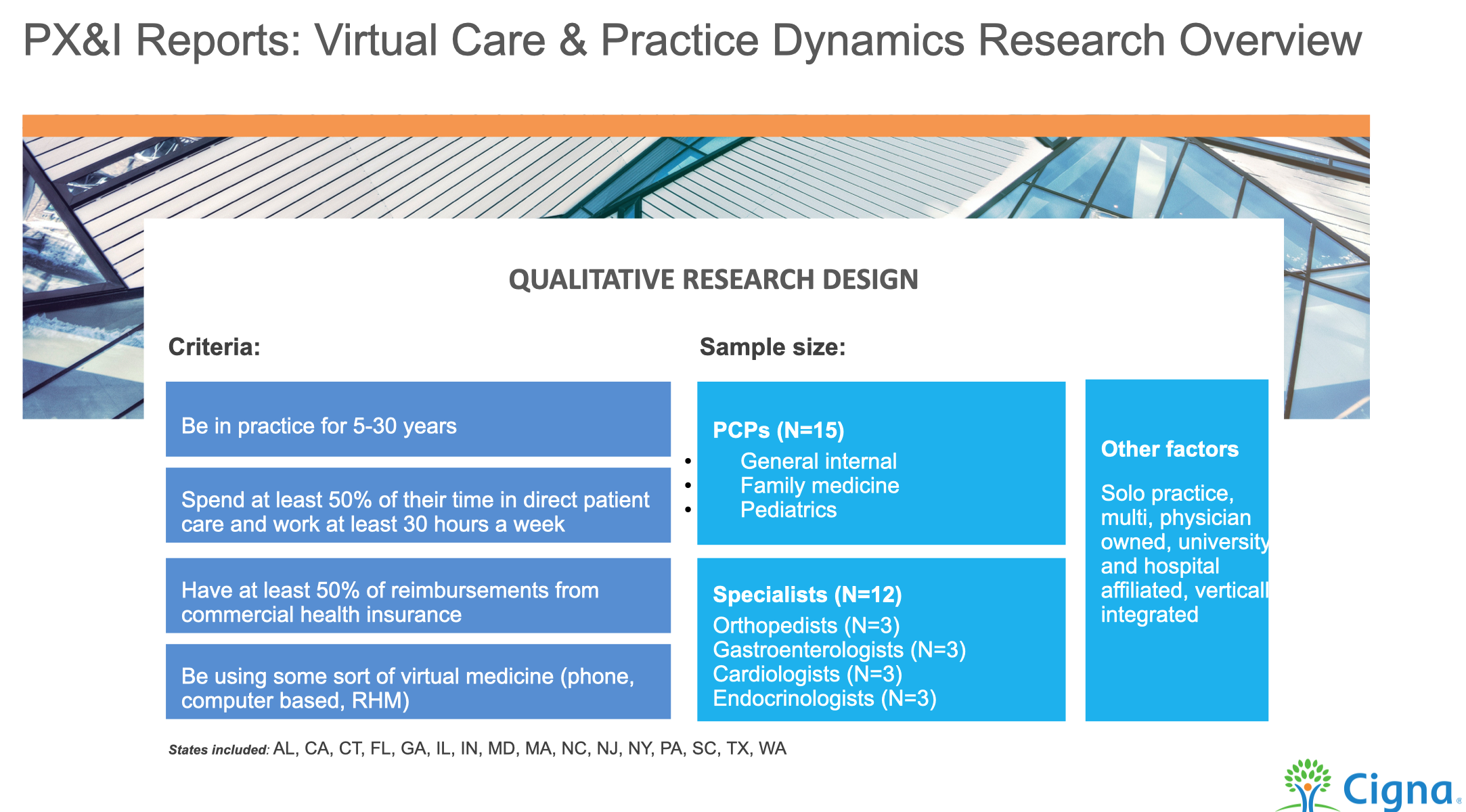

1:1 interviews with providers and staff across demographically diverse markets (large to midsize hospitals, private practice, etc.).

Interviews with SMEs, medical directors across demographically diverse markets.

1:1 interviews with patients (large urban metro to rural locations).

Three rounds of surveys to coincide with each business quarter of the Covid lockdown to track shifting levels of confidence in virtual healthcare solutions.

Contextual inquiry (Go-pro cameras).

Fresh Eyes - Analysis & Outcomes

Inform new policies, products and services that we can pilot and test.

Identify business advantages as the virtual healthcare landscape evolves.

Align on a reimbursement strategy.

Prototype and pilot a portal connecting Cigna’s patient portal with provider’s EHRs

Participatory design workshops.

Prioritize solutions and next steps.

A complex ecosystem with multiple points of entry

UX strategic product research takes us from existing practice dynamics to the “new normal” and the right products and services we can pilot and test.

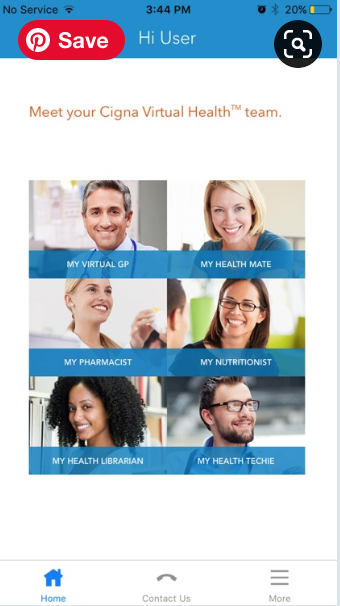

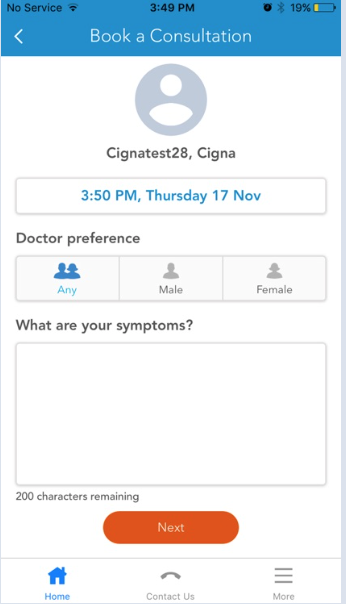

The Cigna Wellbeing® App

UX Research findings were used to strategically inform WHAT we should make in the first place, rather than trying to fix something that didn’t work for the business in the first place.

Proprietary apps were developed, largely in response to MDLIVE taking business away from providers AND the research that proved that providers had a high confidence in telehealth apps — as long as they were in control and patients received quality care.